LLM (large language model) visibility for financial services measures how financial institutions are represented inside AI-generated answers. It tracks how frequently a brand appears, the context of those mentions, and competitor dominance in client-facing searches.

The Search Atlas LLM Visibility tool allows banks, credit unions, fintech innovators, and investment firms, to gain a clear view of brand presence, sentiment, and competitive positioning across AI platforms. The insights below outline practical use cases that show how these insights reinforce trust, protect reputation, and expand visibility in crowded financial markets.

What is LLM Visibility?

LLM visibility is the measurement of how often and in what context a financial institution appears in answers generated by large language models such as ChatGPT, Gemini, Perplexity, and Claude. These platforms are becoming starting points for people researching banks, credit unions, fintech solutions, investment firms, and insurance providers.

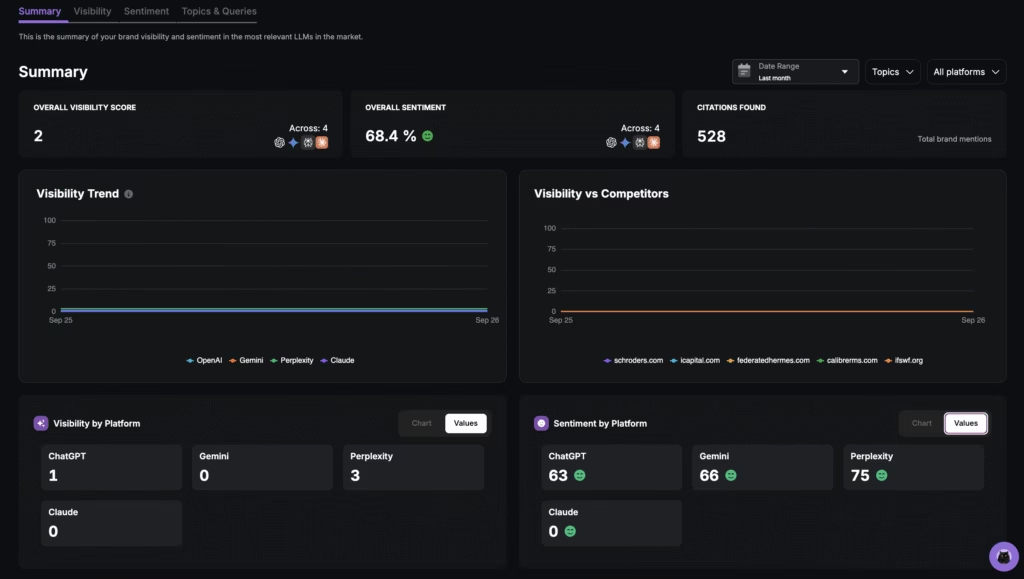

The Search Atlas LLM Visibility tool captures these mentions, analyzes sentiment, and measures how prominently brands are positioned inside AI-generated answers. It delivers visibility scores, competitor benchmarks, and share of voice insights in unified dashboards.

For financial services, this provides a real-time and historical view of brand presence in AI platforms, transforming complex model output into actionable insights that protect credibility, strengthen market authority, and influence client acquisition.

How Does LLM Visibility Work?

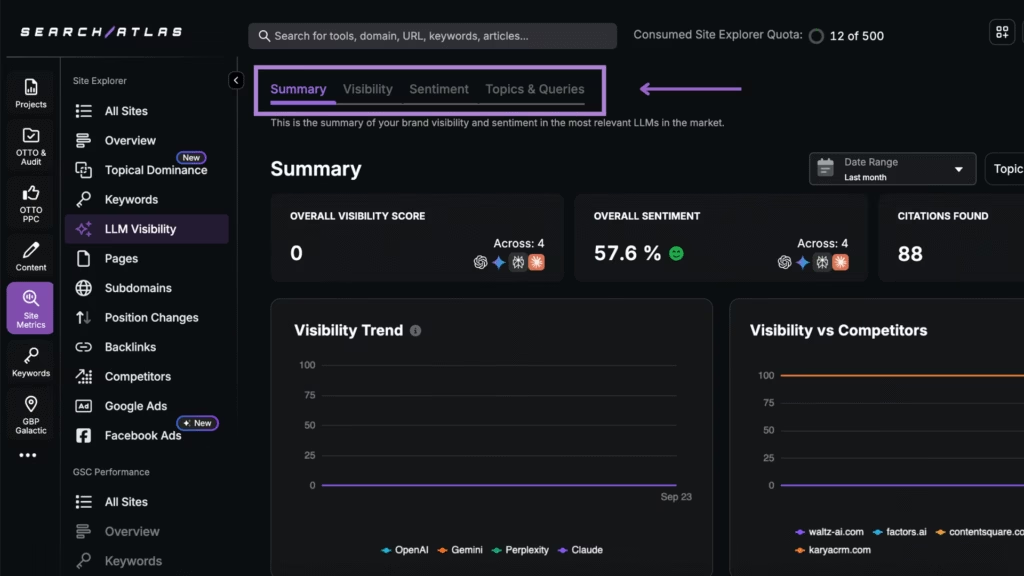

The Search Atlas LLM Visibility tool measures how financial services appear inside answers generated by LLMs. Banks, credit unions, fintech firms, insurers, and investment providers enter their brand and competitors into the dashboard and select the platforms to monitor.

The system scans AI responses, records how often each brand is mentioned, notes placement within answers, and classifies sentiment as positive or negative.

The results of the scan display across 4 dashboards called Summary, Visibility, Sentiment, and Topics & Queries. These dashboards reveal visibility scores, share of voice, sentiment ratings, citation sources, and the exact queries that trigger mentions.

Financial services teams use these insights to benchmark against competitors, refine positioning in client-facing searches and identify misinformation. The tool turns complex AI output into actionable intelligence that strengthens authority, and increases market visibility.

Why LLM Visibility for Financial Services Matters

LLM visibility shapes how banks, fintechs, insurers, and investment firms are recommended in AI-driven searches for financial products and services. As LLMs become a primary gateway for financial discovery, the Search Atlas LLM Visibility tool enables institutions to protect reputation, ensure accuracy, and capture share of voice.

There are 4 main reasons this matters for financial services.

- Improving discovery in client research journeys. LLM visibility shapes how banks, fintechs, insurers, and investment firms are recommended as trusted brands when consumers and businesses ask AI assistants about financial services.

- Reinforcing trust through sentiment monitoring. Clients choose providers they perceive as secure, reliable, and transparent. The Sentiment dashboard shows whether AI assistants frame your institution in positive or negative terms, giving you a way to respond proactively.

- Protecting share of voice in competitive markets. AI assistants now compare financial providers directly. Benchmarks reveal whether competitors dominate mentions, highlighting opportunities to strengthen positioning and expand influence.

- Correcting misinformation and compliance risks. AI responses sometimes surface outdated rates, inaccurate fees, or misleading terms. Monitoring ensures incorrect details are flagged and corrected quickly to protect compliance and client trust.

What Are the Top Use Cases of LLM Visibility for Financial Services?

LLM visibility for financial services captures how banks, credit unions, fintechs, insurers, and investment firms are represented inside AI-generated answers. These insights influence brand discovery, shape client trust, and reveal how institutions compare against rivals in a market where accuracy and authority matter most.

The top use cases of LLM visibility for financial services are listed below.

How Can I See If My Bank Is the First Name AI Mentioned in Finance-Related Queries?

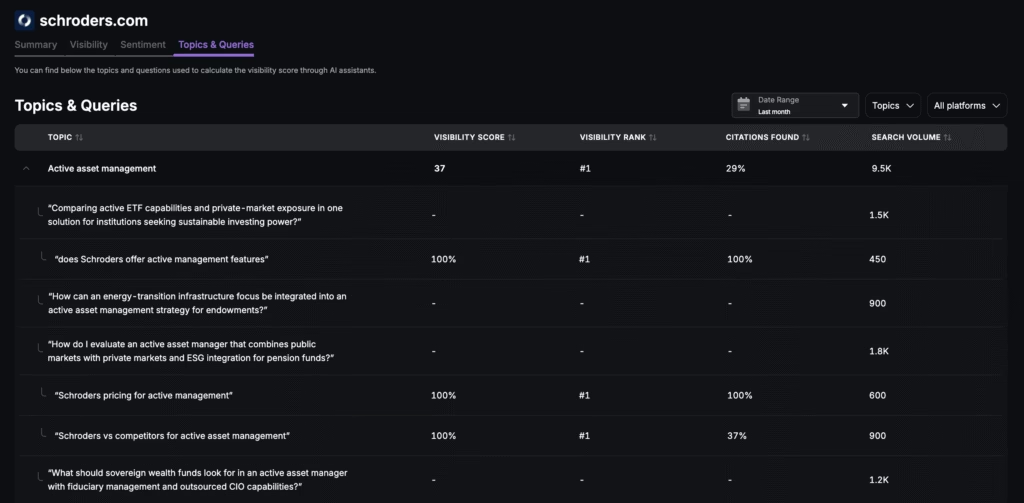

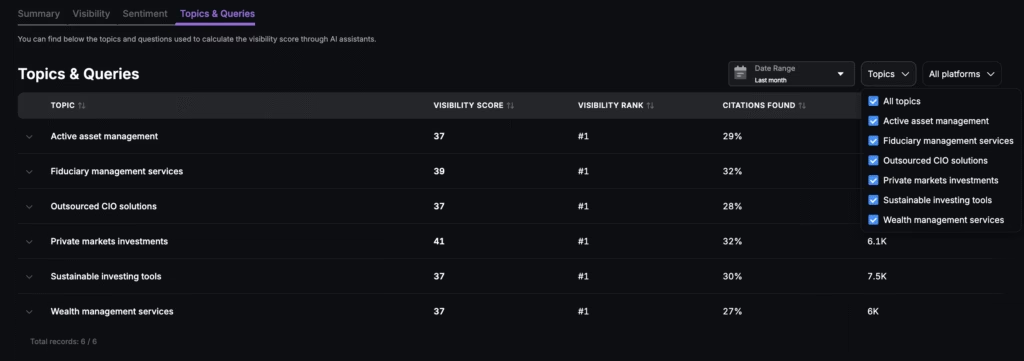

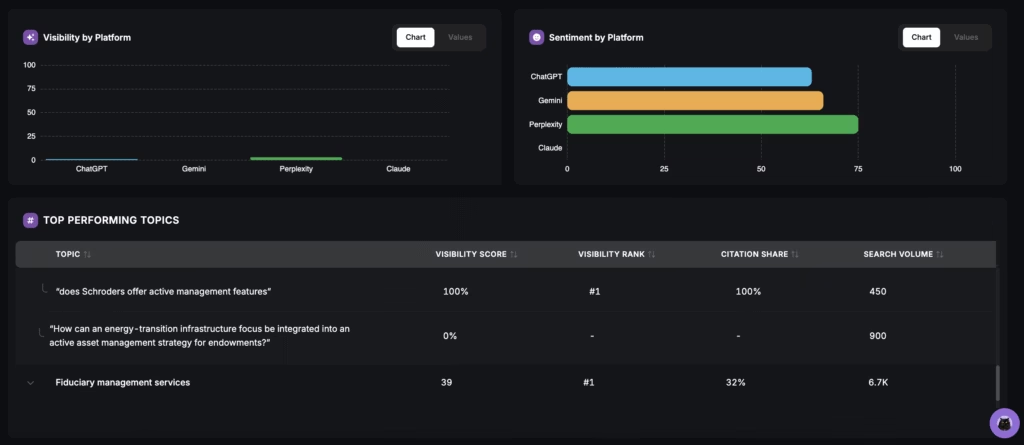

The Topics & Queries dashboard shows the exact prompts that trigger mentions of your institution in AI-generated answers. Each entry includes visibility score, rank, citation share, and search volume, which confirms whether your brand appears first, further down, or not at all.

Tracking these results over time validates whether PR campaigns, partnerships, or market initiatives improve ranking. Being listed first signals authority and trust, while omission highlights competitive risk.

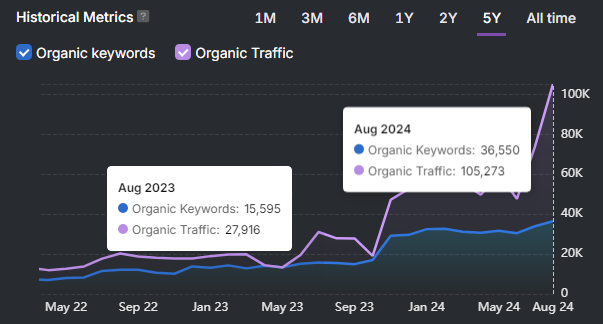

How Do I Measure My Institution’s Overall Visibility Over Time?

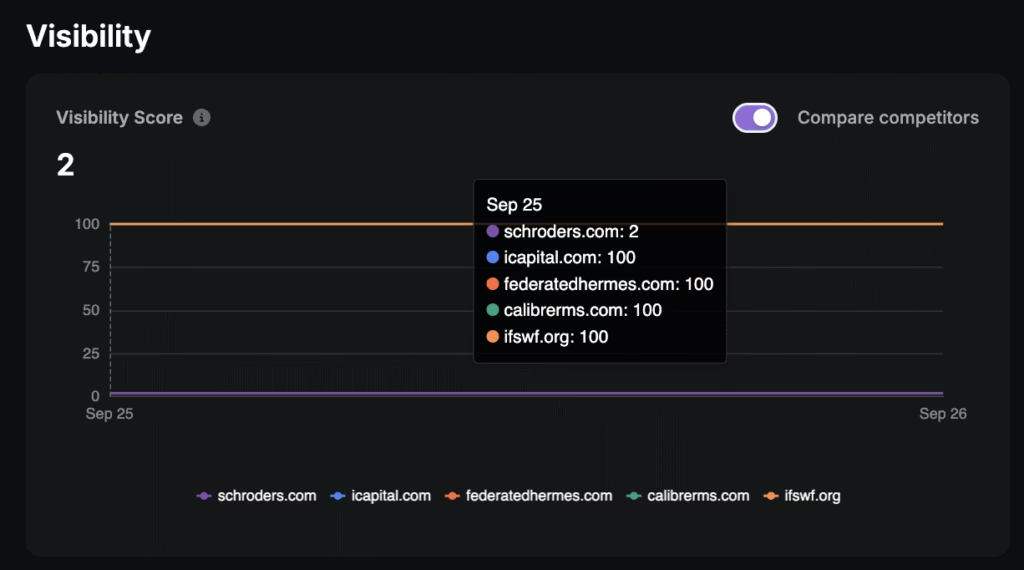

The Visibility Score chart in the Visibility dashboard tracks how often your institution appears in AI-generated answers compared with competitors. Each line represents a brand, showing whether your visibility is strengthening or declining over the selected timeframe.

Reviewing these trends highlights the impact of campaigns, partnerships, or product announcements on brand discovery. Consistent growth in visibility score signals expanding authority, while declines indicate areas where competitors are gaining advantage.

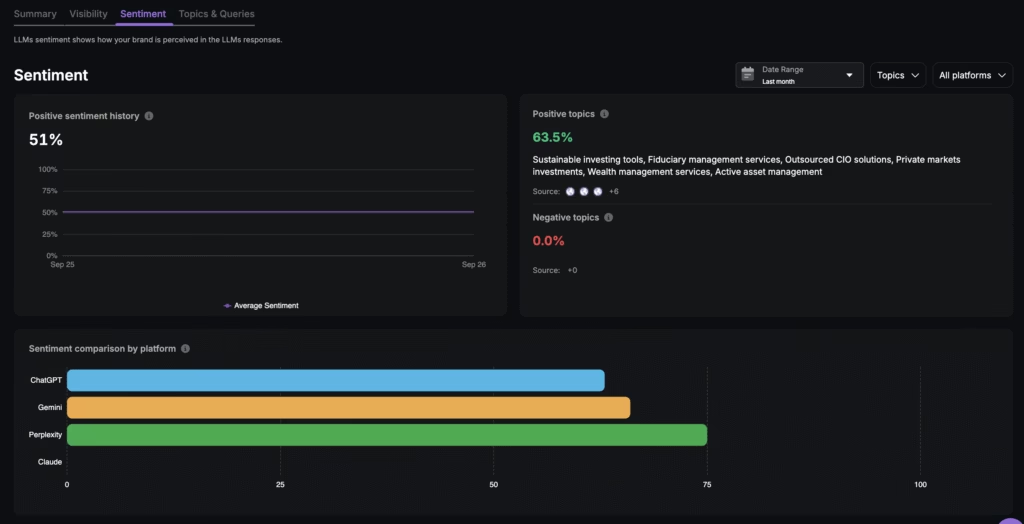

How Do I Track Whether AI Associates My Brand With Trust or Risk?

The Sentiment dashboard measures how AI-generated answers describe your institution, tagging mentions as positive, or negative. It highlights whether descriptors such as reliable or secure dominate, or if concerns like risky or unclear appear more often.

Review sentiment trends to confirm if clients encounter trust-building language or potential red flags. Use these insights to refine communications, adjust disclosures, and strengthen perception before reputation risks spread.

How Can I Benchmark My Financial Institution’s Visibility Against Global Competitors?

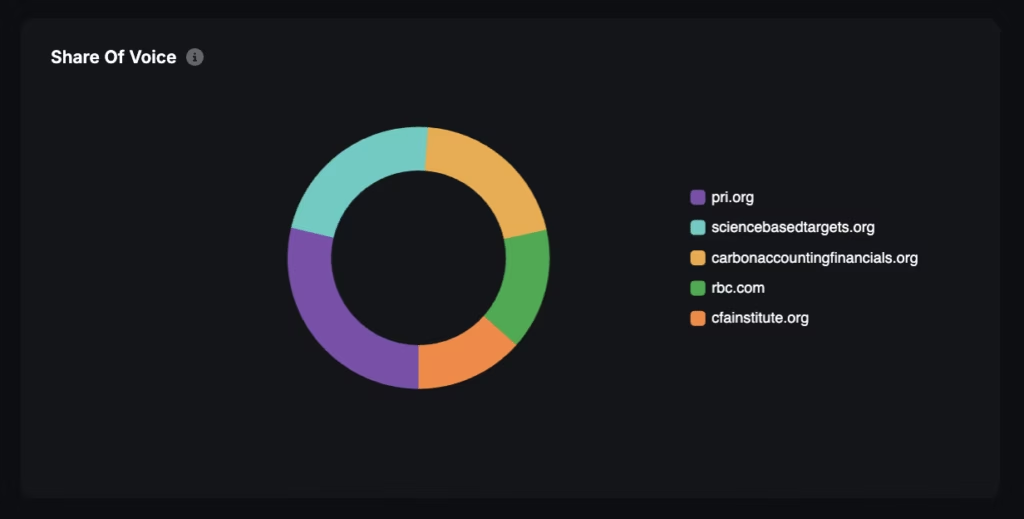

The Visibility dashboard includes a Share of Voice chart that shows what percentage of total AI mentions belong to your brand compared with other institutions. Each segment displays how visibility is distributed across AI-generated answers.

Review this chart to see if global leaders like JPMorgan, Citi, or Vanguard dominate visibility in key categories. Tracking shifts over time highlights where your presence grows, where competitors hold advantage, and which initiatives close the gap.

How Do I Detect If Competitors Dominate AI Mentions in My Core Markets?

The Topics & Queries dashboard reveals which prompts trigger mentions of your brand and which ones highlight competitors instead. Each row lists make it clear when rivals lead in categories such as retirement planning, insurance coverage, or investment services.

Tracking these queries over time shows where your institution is underrepresented and which markets competitors control. Use the insights to target new content, refine messaging, and close visibility gaps in your most important service areas.

How Can I Track Visibility Across Different Service Lines Without Losing Brand Focus?

The Topics & Queries dashboard organizes mentions by themes such as retail banking, insurance, or asset management. This breakdown ensures you understand category-level exposure while maintaining a unified brand view. Tracking service line performance highlights imbalances and directs attention toward areas where your brand needs stronger presence.

How Do I Measure the Impact of Awards, Partnerships, or Media Coverage on AI Visibility?

The Summary and Visibility dashboards compare visibility before and after recognition events such as awards, sponsorships, partnerships, or press coverage. These dashboards track visibility scores, share of voice, and citation sources over time.

Monitoring shifts confirms whether recognition efforts translate into stronger presence in AI-generated answers. Linking visibility gains directly to campaigns proves ROI and demonstrates how branding initiatives increase authority in client-facing searches.

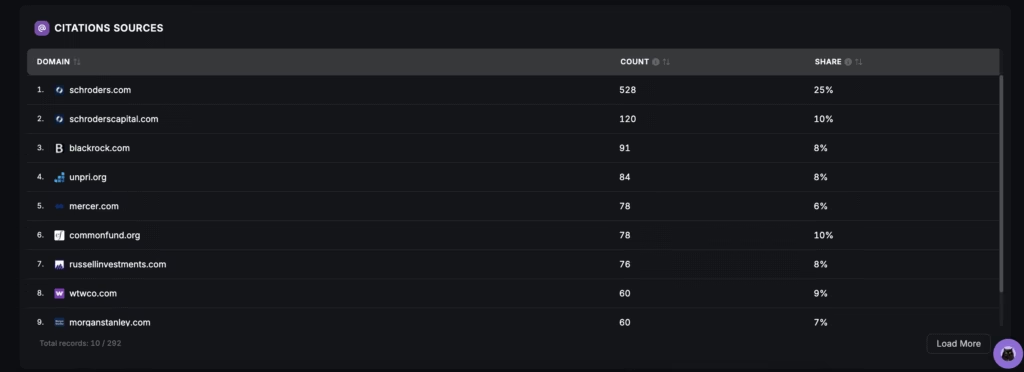

How Can I Identify Which Sources Influence AI Mentions of My Institution?

The Citation Sources table lists the domains AI systems most often reference when generating answers about your institution. Each entry shows how much weight authoritative outlets, financial directories, or outdated profiles carry in shaping perception.

Analyzing these sources highlights where competitors gain credibility from trusted domains and where gaps weaken your profile. Closing these gaps ensures AI assistants pull from accurate, high-quality references, strengthening visibility and reputation.

How Do I Track Financial Discovery in AI-Driven Research Journeys?

To track discovery in AI-driven research, use the Summary dashboard to review visibility trends and top-performing topics. The Top Performing Topics chart highlights the financial themes most often linked to your institution in AI-generated answers.

Within each topic, the dashboard lists prompts such as “best regional banks for mortgages” or “most trusted insurers for small businesses.” Each row includes visibility score, ranking, citation share, and related search volume. Checking the Visibility Trend chart confirms whether mentions rise or fall after campaigns, content updates, or PR initiatives.

How Can I Detect and Correct Misinformation About Fees, Rates, or Compliance in AI Outputs?

The Topics & Queries dashboard highlights the exact prompts where your institution is mentioned in AI-generated answers. Reviewing these queries exposes inaccuracies, such as outdated fees, misleading APR details, or misrepresented compliance standards.

Detecting misinformation at this stage allows your team to update rate pages, adjust FAQ language, or release clarifications through PR and customer communications. Addressing issues quickly prevents false claims from shaping client perception or damaging regulatory trust.

What Is an Example Scenario in Financial Services?

An example scenario illustrates how the Search Atlas LLM Visibility tool turns AI-driven research into actionable insights for banks, credit unions, fintech firms, investment companies, and insurance providers.

Scenario Description

A prospect submits the query “Which banks offer the best high-yield savings accounts in the US?” across multiple AI platforms.

- One AI assistant lists Competitor A.

- Another includes your institution alongside Competitor B.

- A third mentions only Competitor B.

Dashboard Findings

LLM Visibility aggregates these results and presents clear metrics as listed below.

- Share of Voice. Your institution appears in one out of three responses, equaling 33 percent visibility.

- Sentiment. The assistant that mentioned your brand described “competitive rates” positively but flagged “limited branch availability” as negative.

- Competitor Benchmark. Trend data shows Competitor B dominates affordability-related queries, while Competitor A leads in “branch accessibility” topics.

Data Interpretation

The findings reveal inconsistent coverage and mixed sentiment. Missing mentions highlight weak alignment with queries focused on rate comparisons. Competitor B consistently outperforms by controlling affordability-related narratives in AI answers.

Remediation Actions

The actions to improve LLM visibility for this scenario are listed below.

- Publish rate comparison content optimized for savings and deposit searches.

- Reinforce positive descriptors such as “secure” and “reliable” in reviews and messaging.

- Expand branch locator and accessibility resources to address negative perceptions.

- Track shifts in sentiment and share of voice to validate improvements.

This scenario demonstrates a closed-loop process. Firstly, firms identify gaps in AI coverage. Secondly, they implement targeted updates to content and positioning. Thirdly, they measure progress directly in the dashboards to secure stronger placement in AI-driven financial discovery.

Gain clarity on how your institution is represented in AI answers, uncover the benchmarks that define your competitive position, and act on insights that strengthen reputation and client trust.

The Search Atlas LLM Visibility tool turns AI outputs into measurable strategies for growth across banking, insurance, fintech, and investment markets. Start your free trial today and take control of your brand’s visibility in the AI-driven financial landscape.