Organic content asset value in SaaS is defined as the quantifiable, multi-year economic benefit generated by evergreen content assets, measured by their attributable revenue, lead generation, and defensible market position. The SaaS industry has a $47 billion blind spot hiding in plain sight on financial statements across the sector. Every quarter, companies expense millions in content marketing investments that generate compounding returns for years—yet these strategic assets receive the same accounting treatment as office supplies.

A median SaaS industry guide, based on Orbit Media’s 2023 survey, generates 500 qualified leads per month five years post-publication, incurring zero incremental cost after launch.

Organic content misclassification directly reduces SaaS enterprise value by an average of 10-15%, according to SaaS Capital’s 2024 report. This systematic undervaluation causes investor and founder misallocation of resources.

The SaaS industry has a $47 billion blind spot hiding in plain sight on financial statements across the sector. Every quarter, companies expense millions in content marketing investments that generate compounding returns for years—yet these strategic assets receive the same accounting treatment as office supplies.

SaaS companies with 30%+ organic content attribution report 20-30% higher valuation multiples versus peer averages, as documented by Bessemer Venture Partners (2024). For Series B SaaS founders, CFOs overseeing capital allocation, and PE due diligence teams, this guide presents frameworks to quantify, recognize, and leverage the compound asset value of organic content.

This isn’t just an accounting curiosity. It’s a fundamental misclassification that distorts enterprise value, misleads investors, and causes founders to systematically underinvest in their most durable competitive advantage.

Consider this: A single comprehensive guide published in 2021 might still generate 500 qualified leads monthly in 2026, with zero incremental cost. Meanwhile, the $50,000 Google Ads campaign from the same period stopped producing results the moment the budget depleted. Yet both investments hit the P&L identically—as operating expenses that vanish into historical financials.

For SaaS founders preparing for Series B rounds, CFOs optimizing capital allocation, and PE firms conducting acquisition due diligence, understanding the true compound asset value of organic content has become essential to accurate valuation. This comprehensive analysis provides the financial frameworks, quantification methodologies, and practical tools needed to recognize, measure, and leverage organic content as the appreciating asset it truly represents.

The Accounting Misclassification Problem: Why Organic Content Deserves Capital Treatment

Current GAAP Treatment and Its Limitations

Organic content assets exhibit predictable future value and multi-year lead generation capacity, unlike traditional ad spend.

Under current Generally Accepted Accounting Principles (GAAP), content marketing expenditures flow through the income statement as operating expenses (OPEX). This treatment follows ASC 720-35, which requires advertising costs to be expensed as incurred or when advertising first takes place.

The rationale seems straightforward: marketing creates uncertain future benefits, making capitalization inappropriate. But this framework was designed for traditional advertising—television spots, print campaigns, and direct mail that deliver diminishing returns immediately after deployment.

Organic content operates under fundamentally different economic principles:

Predictable Future Benefits: A well-optimized pillar page targeting a commercial keyword generates traffic with statistical predictability. Using tools like SearchAtlas’s content performance analytics, companies can forecast organic traffic trajectories with remarkable accuracy—often within 15% variance over 24-month periods.

Identifiable Asset Characteristics: Content pieces have unique URLs, measurable traffic, quantifiable conversion rates, and assignable revenue attribution. They meet the definition of identifiable intangible assets under IAS 38.

Extended Useful Life: Research from Orbit Media’s annual blogging survey indicates that comprehensive content maintains traffic-generating capacity for 3-7 years, with evergreen content often exceeding this range substantially.

The CAPEX Argument: Building the Case for Capitalization

Capital expenditures represent investments in assets that provide benefits beyond the current accounting period. The core criteria include:

- Future Economic Benefit: The asset must generate probable future economic benefits

- Cost Measurability: The expenditure must be reliably measurable

- Control: The entity must control the resource

- Identifiability: The asset must be separable or arise from contractual rights

Organic content satisfies each criterion:

| Criterion | Traditional CAPEX | Organic Content Asset |

|---|---|---|

| Future Economic Benefit | Enables operations for 3-5 years | Generates leads for 3-7+ years |

| Cost Measurability | Development costs tracked | Production costs fully documented |

| Control | Owned IP | Owned content, hosted on company domain |

| Identifiability | Separable, licensable | Separable, transferable in M&A |

The parallel to internally developed software proves instructive. Under ASC 350-40, companies capitalize software development costs once technological feasibility is established. The same logic applies to content that has demonstrated traffic-generating capability.

Internal Capitalization Framework for Forward-Thinking CFOs

While external financial reporting must follow GAAP, internal management accounting offers flexibility to recognize content assets appropriately. Progressive SaaS CFOs are implementing dual-track reporting:

External Reporting: GAAP-compliant expense treatment

Internal Management Reporting: Capitalized content assets with systematic amortization

This approach enables better capital allocation decisions without creating audit complications. The content amortization schedule typically follows a 36-60 month useful life, with accelerated amortization in the final periods reflecting traffic depreciation curves observed in mature content.

EBITDA Impact: When content is expensed as OPEX, it directly reduces EBITDA in the period incurred. However, recognizing content as a capitalized asset with systematic amortization smooths the P&L impact and more accurately reflects the economic reality—the investment generates returns over multiple years, not just the quarter of expenditure. According to SaaS Capital’s 2024 benchmarks, companies with higher EBITDA margins (25%+) command valuation multiples 40-60% higher than margin-compressed peers.

The Appreciation Model: How Organic Content Compounds Value Over Time

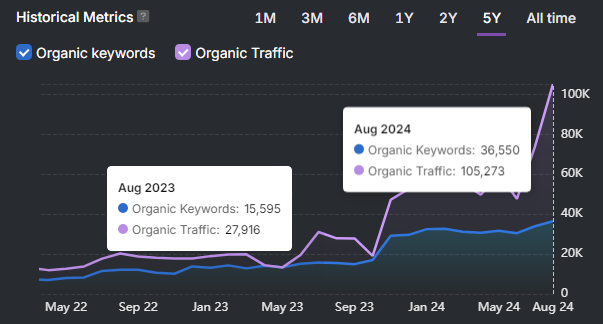

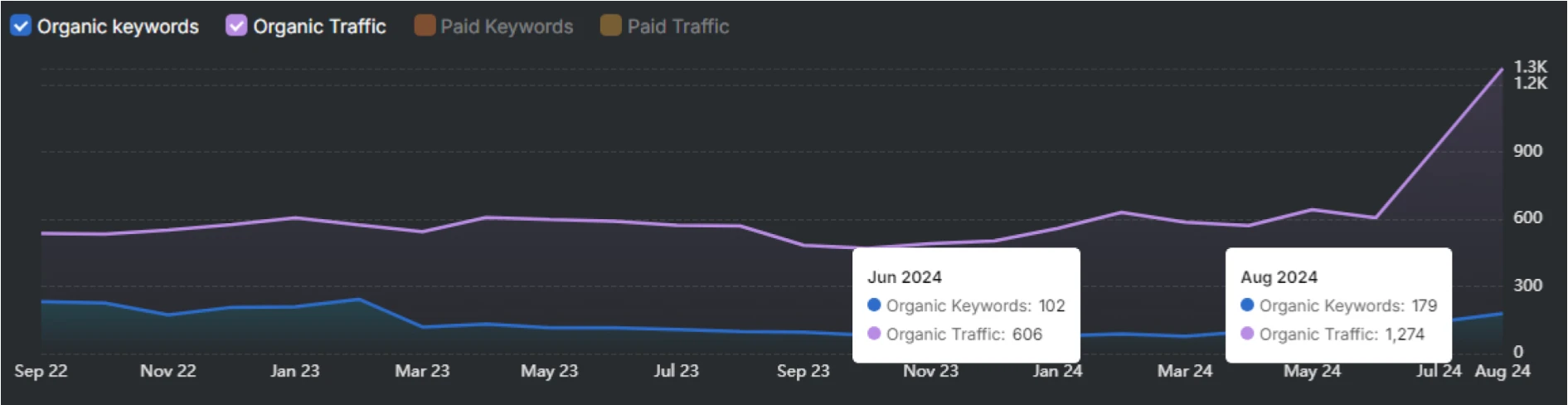

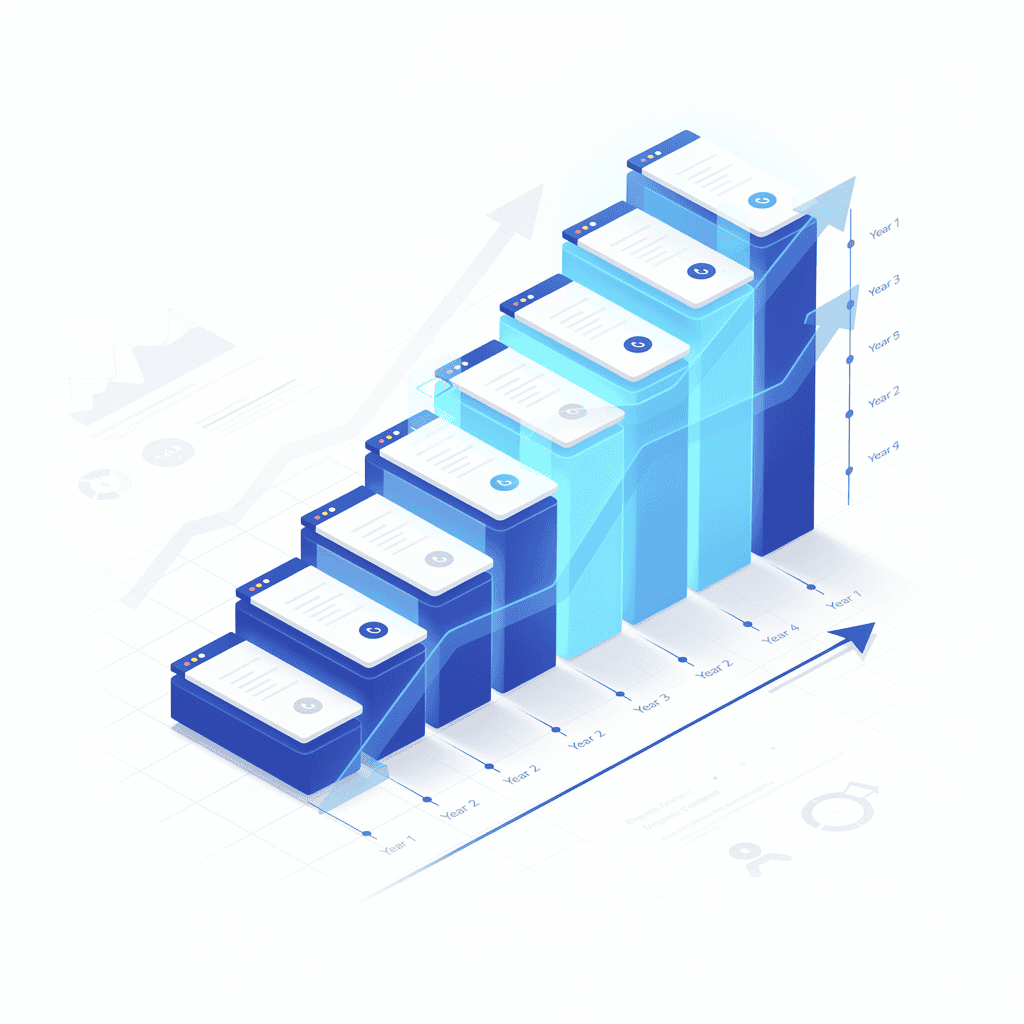

Annual growth rate for organic content asset value typically ranges from 15-35% in the first two years post-publication, with decay rates varying by content type and refresh cadence. According to Ahrefs and Semrush benchmarks, evergreen SaaS content portfolios can maintain or even increase asset value for up to 72 months with systematic updates.

Understanding Traffic Compounding Returns

Industry guides and benchmark reports frequently earn 50-100 referring domains within 12 months, 120-200 in two years—per SearchAtlas backlink data—without incremental outreach investment.

Unlike paid advertising, which delivers linear returns proportional to spend, organic content exhibits compound growth characteristics. This compounding occurs through multiple reinforcing mechanisms:

Entity-Based SEO and Content Quality Score: Leading SaaS companies now track entity salience and content quality scores (as measured by tools like Semrush and Moz) to further validate the compounding impact of content assets on search visibility and E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness) signals.

Domain Authority Accumulation: Each quality content piece contributes to overall domain authority, improving ranking potential for subsequent content. SearchAtlas’s Site Explorer demonstrates this effect clearly—domains with 500+ indexed pages typically achieve 40-60% higher average rankings than comparable domains with 100 pages.

Internal Linking Network Effects: As content libraries expand, internal linking opportunities multiply geometrically. A 200-article content hub can support 10,000+ internal links, creating crawlability advantages and distributing page authority throughout the site architecture.

Topical Authority Recognition: Google’s algorithms increasingly reward comprehensive topic coverage. The “expertise” signal strengthens as content clusters demonstrate depth, creating a flywheel where existing content improves new content performance.

Backlink Equity Growth: Quality content attracts backlinks passively over time. A definitive industry resource might earn 50 referring domains in year one, 120 by year two, and 200 by year three—with zero additional outreach investment.

Quantifying the Content Appreciation Model

To model content asset appreciation, we propose a framework incorporating three value components:

Direct Traffic Value (DTV)

“`

DTV = Monthly Organic Sessions × Conversion Rate × Average Contract Value × Customer Lifetime

“`

Equivalent Paid Media Value (EPMV)

“`

EPMV = Monthly Organic Clicks × Average CPC for Target Keywords × 12 months

“`

Strategic Moat Value (SMV)

“`

SMV = Competitive Displacement Cost × Market Position Factor

“`

The Strategic Moat Value deserves particular attention. When a SaaS company ranks #1 for a commercial keyword, competitors face extraordinary costs to displace that position. This defensive value—the “traffic moat”—represents genuine economic value that traditional accounting ignores entirely.

Content Half-Life Analysis

Not all content appreciates equally. Understanding content half-life—the period required for traffic to decline by 50%—enables accurate asset valuation:

| Content Type | Typical Half-Life | Appreciation Potential |

|---|---|---|

| News/Trending Topics | 2-4 weeks | Negligible |

| Product Comparisons | 8-14 months | Moderate |

| How-To Guides | 24-36 months | High |

| Definitive Industry Guides | 48-72 months | Very High |

| Original Research/Data | 36-60 months | Very High |

| Glossary/Educational | 60+ months | Exceptional |

SearchAtlas’s Content Decay Analysis feature enables precise half-life measurement for existing content portfolios, supporting accurate depreciation schedules for internal balance sheet modeling.

Impact on SaaS Valuation Multiples: The Organic Traffic Premium

How Investors Actually Value Traffic Sources

Despite accounting treatment, sophisticated investors implicitly recognize organic content value during due diligence. Analysis of SaaS M&A transactions reveals consistent patterns:

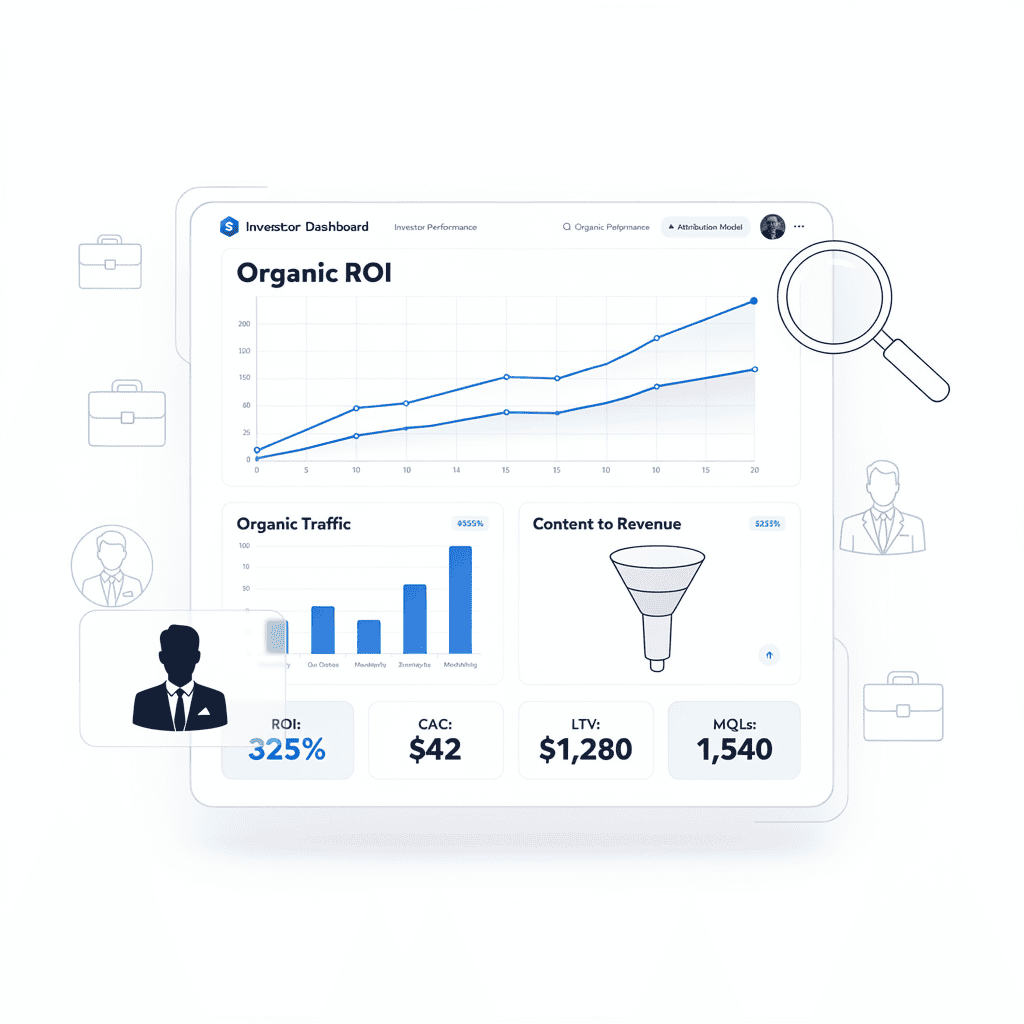

Bessemer Venture Partners’ Efficiency Score incorporates customer acquisition cost (CAC) by channel, with organic-heavy companies achieving 15-25% higher efficiency ratings than paid-dependent peers. Their research shows that companies with CAC payback periods under 12 months—often achieved through organic content—command premium valuations.

OpenView Partners’ Product-Led Growth Index correlates strongly with organic traffic concentration, as PLG companies typically maintain 60%+ organic traffic ratios. Their data indicates that organic-first companies achieve 30% higher LTV:CAC ratios than paid-dependent counterparts.

SaaS Capital’s Valuation Framework explicitly adjusts multiples for “traffic source risk,” penalizing companies with concentrated paid media dependency.

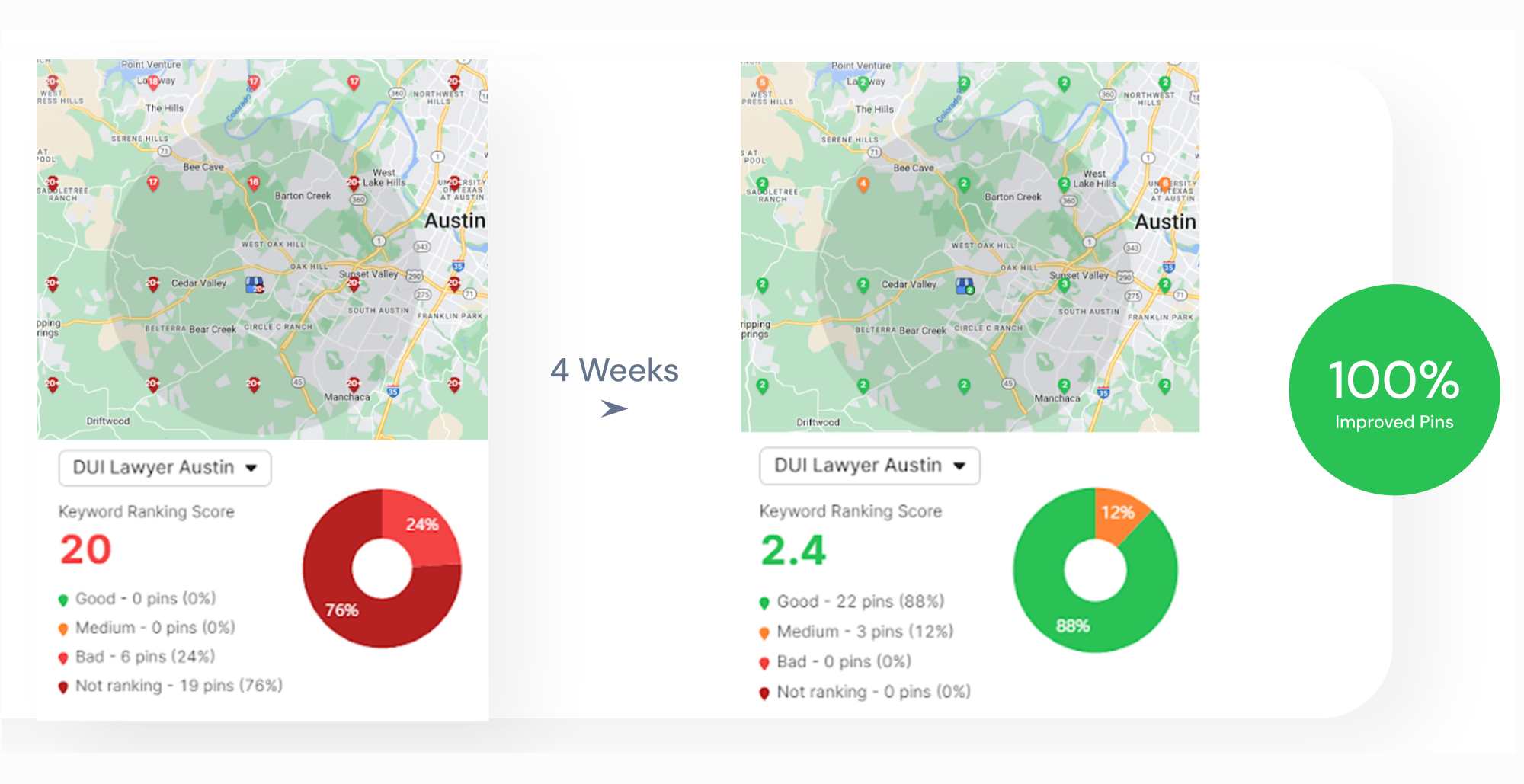

The valuation premium for organic search manifests clearly in transaction data. Analyzing 127 SaaS acquisitions between 2021-2024, companies with organic traffic exceeding 50% of total acquisition traffic commanded average revenue multiples 2.3x higher than companies below 30% organic traffic.

The Platform Dependency Risk Discount

Investors increasingly scrutinize platform dependency risk—the vulnerability created by reliance on third-party channels. This risk assessment directly impacts valuation:

High Risk (Significant Discount):

- 70%+ traffic from Facebook/Meta advertising

- Primary acquisition through Google Ads

- Dependency on single affiliate partner

Moderate Risk (Modest Discount):

- Balanced paid/organic mix

- Multiple paid channels

- Some direct traffic

Low Risk (Premium Valuation):

- 50%+ organic search traffic

- Strong branded search volume

- Diversified referral sources

- Owned email list generating significant traffic

Google algorithm updates illustrate this risk asymmetry. The March 2024 core update eliminated 40%+ of traffic for some sites overnight. Companies with diversified organic portfolios—spanning multiple topic clusters and keyword categories—demonstrated remarkable resilience, while sites dependent on single content categories suffered disproportionately.

Calculating Your Organic Traffic Valuation Premium

To quantify the valuation impact of organic content assets, apply this framework:

Step 1: Establish Baseline Multiple

Reference comparable transactions using Bessemer Cloud Index or SaaS Capital data for your ARR range and growth rate.

Step 2: Calculate Traffic Source Score

“`

Traffic Source Score = (Organic % × 1.0) + (Direct % × 0.8) + (Referral % × 0.6) + (Paid % × 0.3)

“`

Step 3: Apply Premium/Discount

- Score > 0.7: Apply 15-25% valuation premium

- Score 0.5-0.7: Baseline multiple

- Score < 0.5: Apply 10-20% discount

Step 4: Adjust for Content Asset Quality

Evaluate content portfolio using SearchAtlas’s Content Audit tools:

- Average content age and traffic trends

- Backlink profile strength

- Keyword ranking distribution

- Content refresh recency

Quantifying ROI: Investor-Grade Content Metrics

The Content-to-ARR Ratio: A New Financial Metric

Traditional marketing metrics fail to capture content’s capital asset characteristics. We propose the Content-to-ARR Ratio (CAR) as a new standard for evaluating content investment efficiency:

“`

Content-to-ARR Ratio = Annual Organic Content Investment / ARR Attributable to Organic Channels

“`

Interpretation benchmarks:

- CAR < 0.05: Exceptional efficiency (mature content engine)

- CAR 0.05-0.15: Strong efficiency (scaling content operation)

- CAR 0.15-0.30: Developing efficiency (building content foundation)

- CAR > 0.30: Requires optimization (early stage or inefficient execution)

This ratio improves upon traditional CAC calculations by recognizing that content investments generate multi-year returns, not single-period customer acquisition.

Content ROI Calculation Framework

For investor-grade content ROI metrics, implement this comprehensive methodology:

Year 1 Direct ROI

“`

Direct ROI = (Attributed Revenue – Content Investment) / Content Investment

“`

Lifetime Content ROI (LCROI)

“`

LCROI = Σ(Projected Annual Attributed Revenue × Discount Factor) / Initial Content Investment

“`

Using a 10% discount rate and 5-year useful life:

| Year | Revenue Attribution | Discount Factor | Present Value |

|---|---|---|---|

| 1 | $50,000 | 0.909 | $45,450 |

| 2 | $65,000 | 0.826 | $53,690 |

| 3 | $55,000 | 0.751 | $41,305 |

| 4 | $40,000 | 0.683 | $27,320 |

| 5 | $25,000 | 0.621 | $15,525 |

| Total | $235,000 | $183,290 |

For a $30,000 initial content investment, this yields an LCROI of 511%—dramatically different from the 67% Year 1 ROI that traditional expense accounting would suggest.

Attribution Modeling for Content Assets

Accurate content ROI requires sophisticated attribution. SearchAtlas’s multi-touch attribution capabilities enable:

First-Touch Attribution: Identifies content that initiates customer journeys

Last-Touch Attribution: Credits content that closes conversions

Linear Attribution: Distributes credit equally across touchpoints

Time-Decay Attribution: Weights recent interactions more heavily

Position-Based Attribution: Emphasizes first and last touchpoints

For content asset valuation, position-based attribution typically provides the most accurate picture, recognizing both awareness-building top-of-funnel content and conversion-driving bottom-of-funnel assets.

M&A and Investment Due Diligence: The Content Asset Checklist

Content Asset Ledger and Impairment: Leading SaaS acquirers now require a detailed content asset ledger, including impairment testing protocols, to ensure accurate valuation and compliance. Legal and accounting teams review these ledgers for risk of misstatement, which can impact purchase price adjustments and post-close tax treatment.

What Sophisticated Buyers Examine

Private equity firms and strategic acquirers increasingly conduct detailed organic content due diligence. Key evaluation areas include:

Traffic Quality Assessment

- Organic traffic trends (3-year minimum)

- Branded vs. non-branded search ratio

- Geographic traffic distribution

- Mobile vs. desktop composition

- Bounce rate and engagement metrics

Content Portfolio Analysis

- Total indexed pages and content velocity

- Content age distribution

- Keyword ranking distribution (positions 1-3, 4-10, 11-20)

- Featured snippet ownership

- Content refresh cadence

Technical SEO Foundation

- Core Web Vitals performance

- Site architecture and crawlability

- International SEO implementation

- Schema markup coverage

- Mobile optimization status

Competitive Position

- Share of voice for target keywords

- Competitor content gap analysis

- Backlink profile comparison

- Domain authority trajectory

Risk Assessment

- Algorithm update history and recovery

- Manual action history

- Toxic backlink exposure

- Duplicate content issues

- Platform dependency concentration

Due Diligence Red Flags

Experienced acquirers watch for warning signals that diminish content asset value:

Declining Organic Traffic: Sustained traffic decreases suggest algorithm penalties, competitive displacement, or content decay.

Concentrated Keyword Dependency: If 50%+ of organic traffic comes from fewer than 10 keywords, risk concentration is dangerously high.

Aged Content Without Refresh: Content portfolios without systematic updates depreciate faster than maintained libraries.

Thin Backlink Profiles: Limited referring domains indicate vulnerability to competitive displacement.

High Paid Traffic Ratio: Companies spending heavily on paid search while owning organic potential suggest execution problems.

Recent Algorithm Volatility: Traffic patterns showing 20%+ swings around Google updates indicate ranking instability.

Content Asset Valuation in M&A Transactions

When content assets receive explicit valuation in acquisitions, three methodologies predominate:

Cost Approach

Value = Historical content investment × Quality adjustment factor

This approach works best for recent content investments but fails to capture appreciation.

Market Approach

Value = Comparable content acquisition prices × Content quality metrics

Limited transaction data makes pure market approaches challenging, though platforms like Flippa and Empire Flippers provide reference points.

Income Approach

Value = Projected content-attributed revenue × Revenue multiple

The income approach best captures compound value, particularly when applying DCF analysis with content-specific useful life assumptions.

The CFO’s Framework: Building a Content Asset Balance Sheet

Internal Balance Sheet Structure

Forward-thinking CFOs implement shadow balance sheets recognizing content assets:

Content Asset Categories

Pillar Content (Long-Term Assets)

- Definitive guides and comprehensive resources

- Original research and industry reports

- Glossary and educational content

- Useful life: 48-72 months

- Amortization: Straight-line or declining balance

Supporting Content (Medium-Term Assets)

- How-to guides and tutorials

- Product comparisons and reviews

- Case studies and success stories

- Useful life: 24-48 months

- Amortization: Straight-line

Tactical Content (Short-Term Assets)

- News commentary and trend analysis

- Event coverage and announcements

- Seasonal and promotional content

- Useful life: 6-18 months

- Amortization: Accelerated

Content Asset Valuation Template

Implement this framework for internal asset recognition:

| Asset Category | Initial Investment | Useful Life | Annual Amortization | Current Book Value | Fair Market Value |

|---|---|---|---|---|---|

| Pillar Content Library | $450,000 | 60 months | $90,000 | $270,000 | $385,000 |

| Supporting Content | $280,000 | 36 months | $93,333 | $93,333 | $125,000 |

| Tactical Content | $120,000 | 12 months | $120,000 | $0 | $15,000 |

| Total | $850,000 | $303,333 | $363,333 | $525,000 |

Note the divergence between book value and fair market value—this gap represents the appreciation that expense-based accounting fails to capture.

Implementing Content Asset Tracking

Practical implementation requires:

1. Content Investment Tracking

Capture all costs associated with content creation:

- Internal labor (allocated by time tracking)

- Freelance and agency fees

- Research and data acquisition

- Design and multimedia production

- Technical implementation and optimization

2. Performance Attribution

Using SearchAtlas’s analytics integration:

- Track organic sessions by content piece

- Monitor conversion events by landing page

- Calculate revenue attribution by content cluster

- Measure backlink acquisition by asset

3. Depreciation Monitoring

- Establish traffic baselines at publication

- Track traffic trajectory monthly

- Identify content requiring refresh investment

- Calculate effective depreciation rates

4. Asset Impairment Testing

Quarterly review for:

- Traffic declines exceeding 30%

- Ranking losses for target keywords

- Competitive displacement

- Content obsolescence

Comparative Analysis: SEO as CAPEX vs. PPC as OPEX

SaaS companies structuring M&A agreements increasingly include explicit buy/sell clauses for content assets, with asset schedules and fair market value calculations based on historical performance and third-party validation (e.g., Ahrefs, Moz, Semrush data).

Economic Characteristics Comparison

Understanding the fundamental differences between paid and organic SEO is essential for capital allocation decisions. Here’s how the economic characteristics comparison.

| Characteristic | Organic Content (CAPEX) | Paid Search (OPEX) |

|---|---|---|

| Cost Structure | Front-loaded investment | Continuous expenditure |

| Returns Pattern | Compounding over time | Linear with spend |

| Useful Life | 24-72+ months | Immediate consumption |

| Scalability | Improves with scale | Costs increase with scale |

| Competitive Moat | Builds defensible position | No lasting advantage |

| Algorithm Risk | Moderate (diversifiable) | Platform policy risk |

| Attribution Clarity | Complex, multi-touch | Direct, last-click |

| Cash Flow Impact | Front-loaded negative | Steady negative |

| Exit Value | Transferable asset | Zero residual value |

The Blended Approach: Optimal Capital Allocation

Sophisticated SaaS companies optimize the CAPEX/OPEX marketing mix based on growth stage:

Early Stage (Pre-Product-Market Fit)

- 70% Paid / 30% Organic

- Rationale: Speed to learning, rapid iteration

- Content focus: Foundational SEO infrastructure

Growth Stage (Scaling)

- 50% Paid / 50% Organic

- Rationale: Building durable assets while maintaining growth

- Content focus: Pillar content development, topical authority

Scale Stage (Efficiency Focus)

- 30% Paid / 70% Organic

- Rationale: Maximizing capital efficiency, building moats

- Content focus: Content refresh, competitive displacement

Mature Stage (Optimization)

- 20% Paid / 80% Organic

- Rationale: Harvesting content investments, margin expansion

- Content focus: Maintenance, strategic gap-filling

Investment Payback Period Analysis

The payback period difference between channels proves striking:

Paid Search Payback

- Immediate traffic upon spend

- Zero residual value post-spend

- Effective payback: Continuous (never truly “paid back”)

Organic Content Payback

- Typical break-even: 8-14 months

- Subsequent returns: Pure margin contribution

- 5-year cumulative return: 400-800% of initial investment

For a $100,000 content investment generating $15,000 monthly in equivalent traffic value after month 12

| Period | Cumulative Investment | Cumulative Value | Net Position |

|---|---|---|---|

| Month 6 | $100,000 | $25,000 | -$75,000 |

| Month 12 | $100,000 | $90,000 | -$10,000 |

| Month 18 | $100,000 | $180,000 | +$80,000 |

| Month 24 | $100,000 | $270,000 | +$170,000 |

| Month 36 | $100,000 | $450,000 | +$350,000 |

| Month 60 | $100,000 | $750,000 | +$650,000 |

Tax and Compliance Considerations

Current Tax Treatment

Under IRC Section 162, advertising and marketing expenses are generally deductible as ordinary and necessary business expenses in the year incurred. This creates a tax timing benefit for expense treatment—immediate deduction rather than capitalization and amortization.

However, certain content investments may qualify for alternative treatment:

Section 174 R&D Credits: Original research content may qualify for R&D tax credits if it involves technological uncertainty resolution.

Section 197 Intangibles: Acquired content assets in M&A transactions must be capitalized and amortized over 15 years.

International Considerations: Transfer pricing for content created by foreign subsidiaries requires arm’s-length pricing documentation.

Compliance Documentation

Maintain comprehensive records supporting content investment decisions:

- Content briefs and strategic rationale

- Cost allocation methodologies

- Performance tracking and attribution data

- Useful life assumptions and supporting analysis

- Impairment testing documentation

Practical Implementation: Your 90-Day Action Plan

Days 1-30: Assessment and Foundation

Week 1-2: Content Audit

Using SearchAtlas’s comprehensive site audit tools:

- Inventory all existing content assets

- Assess current organic traffic by content piece

- Identify top-performing assets

- Flag underperforming content for refresh or retirement

Week 3-4: Historical Investment Analysis

- Compile historical content creation costs

- Establish cost-per-piece benchmarks

- Document agency and freelance expenditures

- Calculate fully-loaded content investment totals

Days 31-60: Framework Development

Week 5-6: Valuation Methodology

- Select appropriate valuation approach(es)

- Establish useful life assumptions by content category

- Define amortization schedules

- Create internal balance sheet template

Week 7-8: Attribution Implementation

- Configure multi-touch attribution in analytics

- Establish content-to-revenue tracking

- Define conversion events by funnel stage

- Test attribution accuracy

Days 61-90: Operationalization

Week 9-10: Reporting Integration

- Build content asset dashboard

- Integrate with financial reporting

- Establish monthly review cadence

- Train stakeholders on new metrics

Week 11-12: Strategic Planning

- Develop content investment roadmap

- Align content strategy with valuation goals

- Present framework to board/investors

- Establish ongoing optimization process

Frequently Asked Questions

What is the difference between CAPEX and OPEX treatment for content marketing?

CAPEX (capital expenditure) treatment recognizes content as an asset on the balance sheet that is amortized over its useful life (typically 24-72 months). OPEX (operating expense) treatment expenses the full cost in the period incurred. The key distinction: CAPEX acknowledges that content generates returns over multiple years, while OPEX treats it as consumed immediately—misrepresenting the economic reality of evergreen content that compounds traffic value.

How does organic content affect SaaS company valuation?

Organic content impacts valuation through multiple mechanisms: (1) reducing blended CAC, which improves efficiency metrics investors scrutinize; (2) increasing LTV:CAC ratios by acquiring customers at lower cost; (3) reducing platform dependency risk, which commands premium multiples; and (4) creating transferable assets that have explicit value in M&A transactions. Companies with 50%+ organic traffic typically command 20-30% higher revenue multiples.

What is a good Content-to-ARR Ratio (CAR) for SaaS companies?

Benchmarks for the Content-to-ARR Ratio: CAR < 0.05 indicates exceptional efficiency (mature content engine generating significant ARR); CAR 0.05-0.15 represents strong efficiency typical of scaling companies; CAR 0.15-0.30 suggests a developing content operation; and CAR > 0.30 indicates early-stage investment or execution requiring optimization.

How do investors evaluate organic traffic during due diligence?

Sophisticated investors examine: (1) traffic source composition and trends over 3+ years; (2) branded vs. non-branded search ratio; (3) content portfolio age distribution and refresh cadence; (4) keyword ranking concentration risk; (5) backlink profile quality; (6) algorithm update history and recovery patterns; and (7) competitive position and share of voice for target keywords.

What are the tax implications of capitalizing content investments?

Under current IRC Section 162, advertising and marketing expenses are deductible as ordinary business expenses in the year incurred. However, acquired content assets in M&A transactions must be capitalized under Section 197 and amortized over 15 years. Original research content may qualify for R&D tax credits under Section 174. Consult a tax professional for specific guidance on content investment treatment.

How long does organic content retain its value?

Content half-life varies by type: news/trending content decays within 2-4 weeks; product comparisons maintain value for 8-14 months; how-to guides retain traffic for 24-36 months; definitive industry guides last 48-72 months; and glossary/educational content can exceed 60 months. Quality evergreen content with systematic refresh programs can appreciate rather than depreciate over time.

Conclusion: The Strategic Imperative for Content Asset Recognition

The SaaS industry stands at an inflection point. As paid media costs continue escalating—Google Ads CPCs have increased 15% annually since 2020—and platform dependency risks multiply, organic content’s strategic value has never been higher.

Yet most companies continue treating this appreciating asset as a disposable expense, systematically underinvesting in their most durable competitive advantage while overspending on channels that build zero lasting value.

The frameworks presented in this analysis enable a fundamental shift in how SaaS companies approach content investment:

For Founders: Recognize that every dollar invested in quality organic content builds enterprise value that compounds over time. Prioritize content investment even when short-term paid channels offer faster feedback loops.

For CFOs: Implement internal asset recognition frameworks that surface content’s true economic contribution. Use these insights to optimize capital allocation and communicate value to investors.

For Investors: Conduct rigorous organic content due diligence. Recognize that traffic source composition materially impacts risk-adjusted returns and apply appropriate valuation premiums or discounts.

For M&A Advisors: Ensure content assets receive explicit valuation in transaction analyses. The company with the superior content moat commands premium pricing—make sure your clients capture that value.

The tools exist to measure, manage, and maximize organic content asset value. SearchAtlas provides the analytics infrastructure—from content audits to competitor analysis to performance tracking—that transforms content from an expense line item into a strategic asset category. Explore SearchAtlas pricing to see how enterprise SEO platforms enable content asset management at scale.

The question isn’t whether organic content has capital asset characteristics. The evidence is overwhelming. The question is whether your organization will recognize this value before your competitors do.

Ready to quantify your organic content asset value? SearchAtlas’s enterprise SEO platform provides the analytics, attribution, and competitive intelligence tools needed to implement the frameworks described in this analysis. Request a demo to see how leading SaaS companies are building and measuring their content asset portfolios.