The question keeping agency owners awake at night isn’t whether to offer SEO or PPC services—it’s which one will actually keep the lights on when margins get squeezed.

After analyzing financial data from hundreds of digital marketing agencies and interviewing agency owners across the profitability spectrum, one pattern emerges consistently: the services you choose to specialize in fundamentally determine your agency’s financial ceiling. Yet most agency owners make this decision based on team capabilities or client demand rather than cold, hard margin analysis.

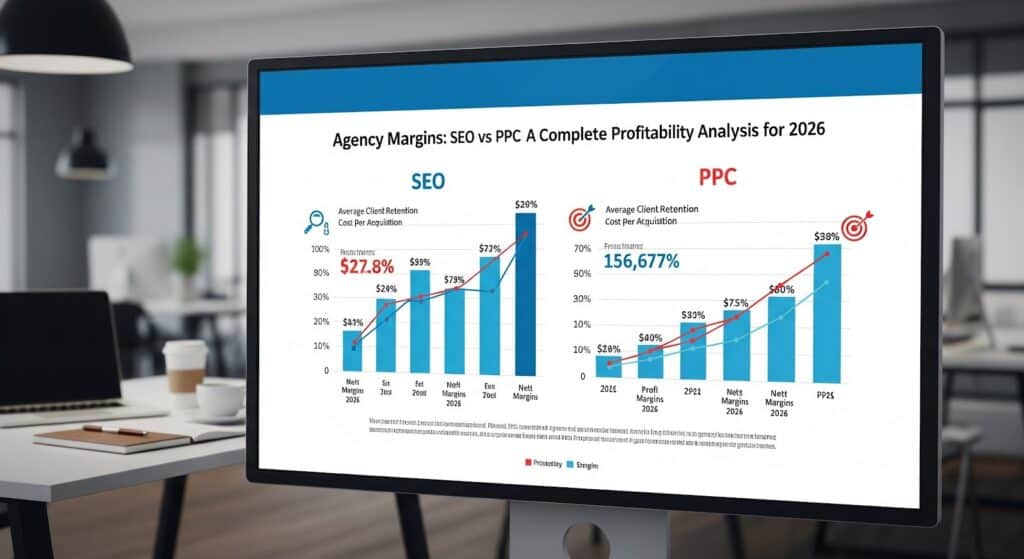

Here’s the uncomfortable truth: while PPC campaigns can generate impressive top-line revenue, SEO services typically deliver 15-25% higher net margins over a three-year client relationship. But that headline figure masks a more nuanced reality that every agency owner needs to understand before making strategic bets on their service mix.

This comprehensive analysis breaks down exactly how SEO and PPC profitability compare across gross margins, net margins, EBITDA, client lifetime value, and operational scalability—giving you the financial framework to make decisions that compound your agency’s profitability through 2026 and beyond.

SEO vs PPC: Which Delivers Higher Agency Margins?

SEO services consistently deliver higher gross and net margins for agencies compared to PPC, due to differences in cost structure, labor scalability, and client retention. While both service models generate revenue, the underlying economics of SEO and PPC create significant margin disparities that agency owners must understand to maximize profitability.

Here’s the uncomfortable truth: Top quartile SEO agencies report net margins 15-25% higher than PPC-focused agencies over a median three-year client engagement, according to industry benchmarks. While PPC campaigns can generate impressive top-line revenue, the long-term net profitability of SEO is typically superior.

The margin comparison between SEO and PPC services isn’t as straightforward as comparing two price tags. Each service model carries distinct cost structures, delivery requirements, and revenue patterns that dramatically impact actual take-home profitability.

Based on industry benchmark data compiled from Agency Analytics, Credo’s Agency Benchmark Report, and proprietary research from Promethean Research, here’s how the numbers typically shake out:

| Metric | SEO Services | PPC Services |

|---|---|---|

| Average Gross Margin | 50-70% | 35-50% |

| Average Net Margin | 15-25% | 10-18% |

| Typical Client Retention | 12-24 months | 6-12 months |

| Average Monthly Retainer | $2,500-$7,500 | $1,500-$5,000 + ad spend % |

| Scalability Ceiling | High | Medium |

| Labor Intensity | Front-loaded | Consistent |

These figures tell a compelling story, but understanding why these differences exist requires diving deeper into the mechanics of each service delivery model.

Defining Gross Margin, Net Margin, and EBITDA for Marketing Agencies

Before comparing profitability, we need to establish a common financial language. Many agency owners conflate these terms, leading to flawed strategic decisions.

Gross Margin represents revenue minus direct costs of service delivery. For an SEO agency, this includes content writer costs, link building expenses, and specialist labor directly tied to client deliverables. For PPC agencies, gross margin calculations must exclude ad spend (which is typically passed through) and focus on management fee revenue minus direct campaign management labor.

Net Margin accounts for all operating expenses including overhead, software subscriptions, office costs, administrative staff, and owner compensation. This figure reveals actual business profitability after running the complete operation.

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) provides a cleaner view of operational profitability by removing financing decisions and accounting treatments. For agencies considering acquisition or investment, EBITDA multiples typically range from 4-8x for well-run operations.

A healthy digital marketing agency should target:

- Gross margins of 50%+ on service delivery

- Net margins of 15-20% minimum

- EBITDA margins of 20-25% for acquisition-ready businesses

Industry Benchmark Data: What Top Agencies Actually Earn

Recent data from Credo’s agency benchmark report reveals that top-quartile SEO agencies achieve gross margins exceeding 65%, while equivalent PPC agencies typically cap around 52%. This 13-point spread compounds dramatically over time.

Moz’s State of Local SEO report indicates that agencies focusing on local SEO specifically report even higher margins—often approaching 70%—due to repeatable deliverable frameworks and lower content production costs.

WordStream’s agency profitability research shows that PPC-focused agencies face consistent margin pressure from:

- Rising platform complexity requiring more specialist knowledge

- Increasing client expectations for reporting granularity

- Competition from automated bidding solutions reducing perceived value

- Ad spend management fees facing downward pricing pressure

The benchmark data consistently shows SEO services commanding premium positioning, but the real margin advantage comes from operational differences we’ll explore next.

Understanding Labor Costs and Scalability in SEO and PPC

Labor represents the single largest cost center for most digital marketing agencies, typically consuming 40-60% of revenue. How efficiently you deploy that labor determines whether you’re building a profitable business or an expensive jobs program.

The SEO Labor Model: Front-Loaded Investment, Compounding Returns

SEO service delivery follows a distinct labor pattern that favors long-term profitability. The initial months of any SEO engagement require intensive work:

- Technical audit and implementation (20-40 hours)

- Content strategy development (10-20 hours)

- Initial content production sprint (variable based on scope)

- Link building campaign launch (15-25 hours)

- Baseline reporting setup (5-10 hours)

This front-loaded investment means SEO agencies often operate at thin or negative margins during months 1-3 of a new client relationship. However, once foundational work completes, ongoing maintenance requires significantly less labor while retainer revenue remains constant.

A mature SEO client in month 12 might require only 40% of the labor hours needed in month 1, while generating identical revenue. This creates the “SEO compounding effect”—where client profitability increases naturally over time without renegotiating contracts.

Example calculation:

- Month 1 SEO client: $5,000 retainer, 50 labor hours = $100/hour effective rate

- Month 12 SEO client: $5,000 retainer, 20 labor hours = $250/hour effective rate

This 150% improvement in effective hourly rate represents pure margin expansion.

The PPC Labor Model: Consistent Effort, Linear Returns

PPC management follows a fundamentally different labor pattern. Campaign optimization requires consistent, ongoing attention regardless of client tenure:

- Daily bid adjustments and budget monitoring

- Weekly performance analysis and reporting

- Monthly strategy refinement and testing

- Quarterly campaign restructuring

- Continuous ad copy testing and iteration

Unlike SEO, a PPC client in month 12 requires essentially the same management hours as month 1. Platform changes, competitive dynamics, and algorithm updates demand perpetual vigilance.

This creates a linear relationship between revenue and labor that caps scalability. Doubling PPC revenue typically requires doubling PPC staff—a constraint that doesn’t apply equally to SEO operations.

Example calculation:

- Month 1 PPC client: $3,000 management fee, 25 labor hours = $120/hour effective rate

- Month 12 PPC client: $3,000 management fee, 23 labor hours = $130/hour effective rate

The marginal efficiency gain of 8% pales compared to SEO’s 150% improvement over the same period.

Billable Utilization: The Hidden Margin Lever

Billable utilization rate—the percentage of paid employee hours directly generating client revenue—dramatically impacts agency profitability. Industry benchmarks suggest:

- Average agency utilization: 60-65%

- High-performing agency utilization: 75-80%

- Maximum sustainable utilization: 85%

SEO teams typically achieve higher utilization rates because deliverables (content, technical fixes, link building) are more easily batched and scheduled. PPC teams face more reactive workloads—platform issues, budget emergencies, and real-time optimization needs—that fragment productive time.

Improving utilization from 65% to 75% on a $100,000 monthly payroll effectively creates $10,000 in additional margin without adding revenue or cutting costs. This operational efficiency advantage compounds SEO’s margin superiority.

Client Retention Rates: Why SEO Clients Typically Stay Longer

SEO clients deliver significantly lower churn rates than PPC clients, directly increasing agency margins. Retention is a primary driver of agency profitability: acquiring a new client costs 5-7x more than retaining an existing one, so reducing churn directly boosts net profit and business valuation.

Retention represents the most undervalued factor in agency profitability calculations. Acquiring a new client costs 5-7x more than retaining an existing one, making churn rate a critical margin determinant.

Churn Rate Comparison: The Numbers Don’t Lie

Churn rate measures the percentage of clients who discontinue services within a given period—typically calculated monthly or annually. For agencies, churn directly impacts revenue stability, profitability forecasting, and business valuation. According to HubSpot’s Agency Pricing & Financials Report, reducing churn by just 5% can increase agency profitability by 25-95%.

Industry data consistently shows SEO clients maintain longer relationships than PPC clients:

| Retention Metric | SEO Clients | PPC Clients |

|---|---|---|

| Average Tenure | 16 months | 9 months |

| Annual Churn Rate | 25-35% | 45-60% |

| First-Year Survival | 70-80% | 50-65% |

| Three-Year Retention | 30-40% | 10-20% |

These differences stem from fundamental service characteristics rather than agency performance.

Why SEO clients stay longer:

- Results compound over time. SEO investments build upon themselves—rankings gained in month 3 support content published in month 8. Leaving means abandoning accumulated equity.

- Switching costs are high. Transitioning SEO providers requires knowledge transfer, strategy realignment, and often temporary ranking disruptions. Clients rationally avoid this friction.

- Attribution is less immediate. SEO results blend into overall business performance, making it harder for clients to isolate and question specific value delivery.

- Relationship depth develops naturally. SEO requires understanding client business models, competitive landscapes, and content ecosystems—creating partnership dynamics rather than vendor relationships.

Why PPC clients churn faster:

- Results are immediately measurable. PPC performance is transparent and attributable, making underperformance (or perceived underperformance) immediately visible.

- Switching is relatively painless. Campaign structures can be exported, and new managers can take over with minimal transition disruption.

- Platform automation threatens perceived value. As Google Ads and Meta improve automated bidding, clients question whether they need agency management.

- Budget sensitivity creates friction. PPC clients experience ad spend as a direct, visible cost—creating more frequent value conversations than SEO retainers.

Calculating Client Lifetime Value (CLV) in Each Channel

Client lifetime value calculations reveal the true economic difference between SEO and PPC clients:

SEO CLV Calculation:

- Average monthly retainer: $4,500

- Average client tenure: 16 months

- Gross margin: 60%

- Gross CLV: $72,000

- Gross profit per client: $43,200

PPC CLV Calculation:

- Average monthly management fee: $2,800

- Average client tenure: 9 months

- Gross margin: 45%

- Gross CLV: $25,200

- Gross profit per client: $11,340

The SEO client delivers 3.8x more gross profit over the relationship lifetime. Even accounting for higher SEO client acquisition costs, the CLV advantage typically exceeds 2.5x.

This CLV differential means SEO-focused agencies can afford to invest more in client acquisition while maintaining superior profitability—a compounding advantage that widens over time.

What Are the Key Benefits and Challenges of Organic SEO vs. Paid Search?

While both organic SEO and Paid Search are critical components of a comprehensive digital strategy, their core benefits and challenges differ fundamentally, especially when considering the long-term financial structure. Organic SEO builds compounding, long-term asset value with higher client retention and lower churn, whereas Paid Search offers immediate, linear, and predictable results at the cost of continuous budget allocation and higher labor demands. The decision between prioritizing one channel over the other comes down to a deep analysis of growth goals versus profitability metrics, a key consideration for agencies assessing the true value of paid SEO vs organic SEO.

Revenue Models: Recurring SEO Retainers vs Project-Based PPC

For example, agencies specializing in local SEO (e.g., for dental or legal practices) often achieve higher MRR stability due to ongoing optimization needs, while e-commerce-focused PPC agencies may experience greater revenue volatility during seasonal peaks.

Revenue predictability impacts agency valuation, operational planning, and owner stress levels. The structural differences between SEO and PPC revenue models create distinct business dynamics.

Explaining Monthly Recurring Revenue (MRR) for Agencies

Monthly recurring revenue represents contracted, predictable income that renews without active reselling. MRR is calculated by multiplying the number of active clients by the average revenue per client, excluding one-time fees and variable components. High MRR businesses command premium valuations—typically 4-8x annual recurring revenue according to SaaS Capital’s benchmarks—because they reduce revenue volatility and enable confident resource planning.

SEO’s MRR Advantage:

SEO services naturally align with retainer models because results require sustained effort over time. Clients understand that stopping SEO means losing momentum—creating natural renewal incentives.

Typical SEO MRR characteristics:

- 85-95% of revenue from retainer contracts

- 3-12 month minimum commitments standard

- Automatic renewal clauses common

- Price increases easier to implement annually

PPC’s MRR Challenges:

PPC revenue often carries more variability despite retainer structures:

- Management fees tied to ad spend percentages fluctuate with client budgets

- Seasonal businesses create predictable but significant revenue swings

- Performance concerns trigger more frequent contract renegotiations

- Project-based campaign work (launches, promotions) creates revenue spikes and valleys

An agency with $500,000 in annual SEO retainer revenue typically carries lower risk than one with $500,000 in PPC management fees—even at identical top-line figures.

Performance-Based and Hybrid Pricing Models

The pricing model landscape has evolved significantly, with agencies experimenting beyond traditional retainers:

Performance-Based SEO Pricing:

- Pay-per-ranking models (increasingly rare due to algorithm volatility)

- Revenue share arrangements (effective for e-commerce clients)

- Lead generation fees (common in local SEO)

Performance-based SEO can deliver exceptional margins when results exceed expectations, but introduces significant revenue unpredictability and requires sophisticated tracking infrastructure.

Hybrid PPC Pricing:

- Base retainer + performance bonus structures

- Tiered management fees based on spend thresholds

- Profit-share models tied to ROAS improvements

Hybrid models attempt to align agency and client incentives while maintaining revenue predictability. The most profitable agencies typically maintain 70%+ of revenue in pure retainer form while using performance components for client retention and upselling.

White-Label SEO: The Margin Multiplication Strategy

White-label SEO services represent a unique margin opportunity that doesn’t exist equivalently in PPC. Agencies can purchase SEO deliverables from specialized providers at wholesale rates, applying markup while maintaining client relationships.

White-label SEO margin structure:

- Wholesale content cost: $150 per 1,500-word article

- Client billing rate: $400-600 per article

- Gross margin on content: 60-75%

- Wholesale link building cost: $200 per placement

- Client billing rate: $400-800 per placement

- Gross margin on links: 50-75%

This arbitrage opportunity allows agencies to scale SEO delivery without proportional headcount increases. Platforms like SearchAtlas enable this model by providing white-label SEO tools and deliverables that agencies can rebrand and resell, dramatically improving operational efficiency.

White-label PPC management exists but faces structural limitations—campaign management requires real-time attention that’s difficult to outsource without quality degradation.

Cost Structure Deep Dive: Fixed vs Variable Expenses

| Entity | Attribute | Value/Example |

|---|---|---|

| SEO labor model | Scalability | Compounding (labor hours decrease over time) |

| PPC labor model | Scalability | Linear (labor hours remain constant) |

| SEO agency | Fixed cost ratio | 40-50% (e.g., software, management salaries) |

| PPC agency | Variable cost | Campaign manager salaries scale with clients |

| White-label SEO | Margin impact | 50-75% gross margin on fulfillment |

Understanding cost behavior under different revenue scenarios reveals which service model better withstands market volatility.

SEO Agency Cost Structure

Fixed Costs (remain constant regardless of client count):

- SEO software subscriptions (SearchAtlas, rank trackers, technical audit tools)

- Office overhead and administrative staff

- Management salaries

- Basic infrastructure

Variable Costs (scale with client acquisition):

- Content production (internal or outsourced)

- Link building expenses

- Specialist contractor hours

- Client-specific tool costs

SEO agencies typically operate with 40-50% fixed costs, meaning significant operating leverage exists. Adding clients beyond breakeven drops revenue almost directly to profit.

PPC Agency Cost Structure

Fixed Costs:

- Platform certifications and training

- Reporting and analytics tools

- Office overhead and administrative staff

- Management salaries

Variable Costs:

- Campaign manager salaries (scale linearly with client count)

- Platform-specific tools and bid management software

- Creative production for ad assets

- Client-specific tracking implementation

PPC agencies typically operate with 30-40% fixed costs, with labor representing the dominant variable expense. This creates less operating leverage—growth requires proportional cost increases.

Breakeven Analysis Comparison

SEO Agency Breakeven Example:

- Fixed monthly costs: $50,000

- Average client contribution margin: $2,500

- Breakeven: 20 clients

- Each client beyond 20 contributes $2,500 to profit

PPC Agency Breakeven Example:

- Fixed monthly costs: $40,000

- Average client contribution margin: $1,200

- Breakeven: 33 clients

- Each client beyond 33 contributes $1,200 to profit

The SEO agency reaches profitability faster and generates more profit per incremental client—a structural advantage that compounds over time.

Technology Stack Impact on Agency Margins

Beyond cost structure, technology investments further differentiate SEO and PPC margin potential by enabling automation, reducing manual labor, and scaling deliverables without proportional headcount increases.

The tools agencies use directly impact delivery efficiency and, consequently, margins. Strategic technology investments can shift margin profiles significantly.

SEO Technology Leverage

Modern SEO platforms consolidate previously fragmented workflows, reducing labor hours per client:

Before platform consolidation:

- Rank tracking: Tool A (15 minutes daily)

- Technical audits: Tool B (2 hours monthly)

- Content optimization: Tool C (1 hour per piece)

- Link analysis: Tool D (30 minutes weekly)

- Reporting: Manual compilation (3 hours monthly)

After platform consolidation (using SearchAtlas as example):

- All functions integrated: 60% time reduction

- Automated reporting: 80% time reduction

- AI-assisted content optimization: 40% time reduction

- White-label client dashboards: Eliminates custom reporting

Agencies using consolidated platforms like SearchAtlas report 25-40% improvements in effective hourly rates through workflow efficiency gains. This technology leverage amplifies SEO’s inherent margin advantages.

PPC Technology Considerations

PPC management tools have evolved significantly, but efficiency gains face platform limitations:

- Google Ads interface changes frequently disrupt workflows

- Automated bidding reduces manual optimization needs but also perceived agency value

- Cross-platform management (Google, Meta, Microsoft) requires multiple tool investments

- Creative production tools add costs without proportional efficiency gains

The technology trajectory in PPC points toward commoditization—automated solutions increasingly handle tasks that previously justified agency fees. SEO technology evolution, conversely, enhances agency capabilities rather than replacing them.

Building Your Agency’s Optimal Service Mix

Pure-play SEO or PPC agencies exist, but most successful agencies offer both services. The strategic question becomes: what ratio optimizes overall profitability?

The 70/30 SEO-Dominant Model

Agencies achieving highest margins typically maintain 70% SEO revenue with 30% PPC revenue. This ratio:

- Maximizes high-margin recurring revenue

- Provides PPC as client retention tool (clients wanting “full service”)

- Creates cross-sell opportunities without operational complexity

- Maintains focus on SEO excellence rather than spreading thin

The Integrated Full-Service Model

Agencies offering equal SEO/PPC splits face margin pressure but gain:

- Larger addressable client market

- Higher average contract values

- Reduced client churn through service bundling

- More comprehensive data for optimization

The integrated model works when agencies achieve operational excellence in both disciplines—a challenging bar that many agencies fail to clear.

The White-Label Arbitrage Model

Agencies can optimize margins by:

- Selling SEO and PPC services to clients

- Fulfilling SEO through white-label partnerships (high margin)

- Managing PPC in-house (necessary for quality control)

- Focusing internal expertise on client strategy and relationships

This model achieves SEO-level margins on SEO revenue while maintaining PPC capabilities for client retention. SearchAtlas’s white-label solutions enable this approach by providing enterprise-grade SEO deliverables at wholesale pricing.

Profit Maximization Playbook: Actionable Strategies

Apply these 8 specific strategies to maximize SEO and PPC margins:

Theory matters less than execution. Here are concrete strategies for improving agency margins in both service lines:

SEO Margin Improvement Tactics

1. Productize service delivery

Create standardized packages with defined deliverables rather than custom scoping each engagement. Productization enables:

- Faster sales cycles

- More accurate cost estimation

- Easier staff training

- Consistent quality delivery

2. Implement content production systems

Content represents the largest variable cost in SEO delivery. Systematize through:

- Detailed briefs reducing revision cycles

- Writer training programs improving first-draft quality

- AI-assisted optimization reducing editing time

- Template libraries for common content types

3. Extend client lifetime value

Every additional month of retention improves CLV without acquisition cost:

- Quarterly business reviews demonstrating value

- Proactive strategy updates before clients request them

- Regular communication cadences building relationships

- Expansion offers introducing additional services

4. Leverage white-label partnerships

Platforms like SearchAtlas enable margin expansion through:

- Wholesale content and link building pricing

- Branded client dashboards reducing reporting labor

- Enterprise tools without enterprise pricing

- Scalable delivery without headcount increases

PPC Margin Improvement Tactics

1. Establish minimum management fees

Small accounts consume disproportionate attention. Set minimums that ensure profitability:

- $1,500/month minimum management fee

- Or 15% of ad spend, whichever is greater

- Decline accounts below profitability thresholds

2. Automate reporting ruthlessly

Reporting consumes 15-20% of PPC manager time. Automate through:

- Scheduled report generation and delivery

- Client dashboard access reducing ad-hoc requests

- Template libraries for common analyses

- Executive summary automation

3. Specialize by vertical

Vertical specialization enables:

- Reusable campaign structures

- Accumulated optimization knowledge

- Higher close rates from demonstrated expertise

- Premium pricing justified by specialization

4. Bundle with SEO services

PPC-only clients churn faster. Bundling with SEO:

- Increases average contract value

- Improves retention through service integration

- Creates cross-channel optimization opportunities

- Justifies premium pricing for comprehensive strategy

Looking Ahead: 2026 Margin Projections

SEO margin advantages include: 1) AI content tools (e.g., Jasper, Copy.ai) lowering production costs; 2) Increasing technical complexity (such as advanced schema markup) making DIY optimization harder for clients; 3) Search innovation (like voice and visual search) opening new service lines (e.g., Google Discover optimization).

Market dynamics suggest SEO’s margin advantage will widen through 2026:

PPC margin pressures include: 1) Platform automation (e.g., Google Ads Smart Bidding) reducing perceived agency value; 2) Rising cost-per-click (CPC) squeezing client budgets, especially in competitive verticals like legal and insurance; 3) Privacy regulations (such as GDPR and CCPA) limiting audience targeting; 4) In-housing trends as platforms simplify interfaces, leading brands to manage campaigns internally.

Factors favoring SEO margins:

- AI content tools reducing production costs

- Increasing organic search complexity raising barriers to DIY

- Voice and visual search creating new optimization opportunities

- Privacy changes limiting paid advertising effectiveness

Factors pressuring PPC margins:

- Platform automation reducing perceived agency value

- Rising CPCs squeezing client budgets

- Privacy regulations limiting targeting capabilities

- In-housing trends as platforms simplify interfaces

Agencies positioning for 2026 success should:

- Build SEO capabilities and expertise

- Invest in technology platforms enabling efficiency

- Develop white-label partnerships for scalable delivery

- Maintain PPC capabilities for client retention while managing profitability expectations

Frequently Asked Questions

What are the key differences in profitability between SEO and PPC services?

SEO services typically deliver 50-70% gross margins compared to PPC’s 35-50%, primarily due to labor economics. SEO work is front-loaded, meaning client profitability increases over time as maintenance requires fewer hours than initial setup. PPC management requires consistent effort regardless of client tenure, creating linear rather than compounding returns.

How can agencies improve client retention rates?

Agencies can improve retention by conducting quarterly business reviews demonstrating ROI, providing proactive strategy updates before clients request them, building relationship depth through consistent communication, and offering expansion services that increase switching costs. SEO services naturally retain better because results compound over time and transitioning providers risks losing accumulated ranking equity.

What is the impact of churn on agency revenue and valuation?

Churn directly impacts agency valuation multiples—businesses with lower churn command higher EBITDA multiples (often 6-8x versus 3-4x for high-churn agencies). A 5% reduction in monthly churn can increase profitability by 25-95% because retained clients require no acquisition cost while continuing to generate revenue.

How does the choice between SEO and PPC affect long-term agency growth?

SEO-focused agencies build more sustainable growth trajectories because client lifetime value is 3-4x higher, recurring revenue is more predictable, and delivery can scale through white-label partnerships without proportional headcount increases. PPC agencies face structural constraints where growth requires linear staff increases.

What is a healthy profit margin for a digital marketing agency?

Healthy agencies target gross margins of 50%+ on service delivery, net margins of 15-20% minimum, and EBITDA margins of 20-25% for acquisition-ready businesses. Top-performing SEO agencies achieve gross margins exceeding 65%, while PPC agencies typically cap around 52%.

How can white-label partnerships improve agency margins?

White-label SEO enables agencies to purchase deliverables at wholesale rates (content at $150/article, links at $200/placement) while billing clients premium rates ($400-600/article, $400-800/link). This creates 50-75% margins on fulfillment without proportional headcount increases, dramatically improving operational leverage.

Conclusion: Making the Margin Decision

The data is clear: SEO services deliver superior agency margins through higher gross margins, better client retention, more favorable labor economics, and stronger recurring revenue characteristics. PPC services remain valuable for client acquisition and retention but face structural margin pressures that will likely intensify.

Key takeaways for agency owners:

- Prioritize SEO revenue growth for maximum margin impact

- Invest in efficiency technology like SearchAtlas to amplify inherent SEO advantages

- Leverage white-label partnerships to scale delivery without proportional cost increases

- Maintain PPC capabilities strategically for client retention rather than margin generation

- Track CLV by service line to understand true profitability beyond monthly figures

The agencies thriving in 2026 will be those making deliberate service mix decisions based on margin analysis rather than market momentum. The opportunity to build a highly profitable agency exists—but only for those willing to follow the numbers where they lead.

Ready to improve your agency’s SEO margins? SearchAtlas provides the integrated platform and white-label solutions that enable agencies to deliver enterprise-grade SEO at scale. [Explore how SearchAtlas can transform your agency’s profitability →